How Does Credit Card Processing Work?

As a business owner, you don’t need to have intimate knowledge of the inner workings of the bankcard system or ach payment processing, but it’s wise to have a basic understanding of how credit card processing works so that you understand how the different fees you incur come about.

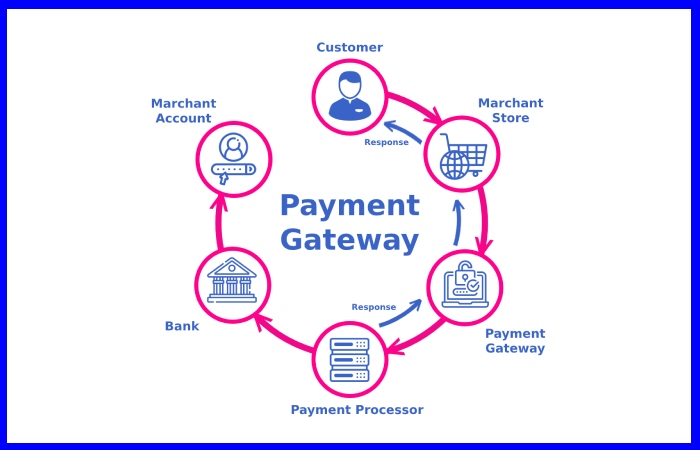

So, how does credit card processing work?

The easiest way to understand how it works is by looking closely at the key players in the transactions and their roles.

Table of Contents

Cardholder

This is the person that obtains the credit card from the bank or any other financial institution. Upon consuming your product or service, the cardholder swipes or inserts the card in the point-of-sale terminal.

Merchant

Now, as a business owner, you fall here. After the cardholder has tapped, swiped, or inserted their card in your payment terminal, your bank gets a notification to approve the payment.

The bank then gets authorization for the purchase from the credit card network.

The payment network then communicates electronically with the card issuer to ensure that the card is valid and there is enough credit to cover the purchase.

If everything is good, you (the merchant) receive an authorization code from the card issuer showing that the payment has been approved.

You should give a receipt to the cardholder as proof of payment.

At the end of a working day, you send a list of the credit card transactions to your bank, and the bank directs the transaction to the correct payment processor so that you can receive your payment.

Payment Gateway

Also known as the payment management solution. The payment gateway provides a front-end solution for merchants by allowing them to accept credit card payments.

Once the credit card transaction has been authorized. The payment gateway sends approval to the payment processor to reconcile the transaction.

The payment processor deposits the transaction amount in your acquiring bank (minus any fees).

In most cases, this transaction takes one to two days. As the merchant, you should bundle your transactions. And send them to the bank at the end of a working day to be processed as a batch. This comes in handy for saving you money.

Credit Card Network

This is the intermediary in the credit card processing transaction. The payment processor deposits money in the bank account. The card network deducts the purchase amount from the card-issuing bank before sending the transaction balance to the payment processor or acquiring bank (minus fees).

Card Issuing Bank

From the name, this is the financial institution that approved the cardholder. The bank receives the payment request and sends back a credit card decline or approval.

If the cardholder has enough credit, the card-issuing bank deducts the amount from the cardholder’s account. And sends an invoice or statement (minus fees).

That is how it works

This explains how credit card processing works. As a merchant, you should be cautious of the payment gateway you use.

And as a rule of thumb, do thorough research and read the fine print to ensure that you fully understand all the fees involved.

You don’t want to work hard and the payment gateway eats all of your profits, do you?